Let me tell you a story.

Not about crypto.

Not about finance.

About machines doing the right thing, quietly.

A small pause: what does DAG really mean?

DAG stands for Directed Acyclic Graph.

Big words. Simple idea.

Think of it like this.

Old way (normal systems)

Imagine a single queue at a billing counter.

One person pays.

Then the next.

Everyone waits in line.

If the line is long, everything slows down.

That is how many old payment systems work.

DAG way (simple picture)

Now imagine many small counters, all open at the same time.

People don’t stand in one line.

They just go to the nearest free counter.

Each payment:

- moves forward

- never goes back

- does not block others

That is a DAG.

Even simpler: a family analogy

Think of a family expense notebook kept on the dining table.

- Anyone can write their expense anytime

- Each new entry looks at a few earlier entries

- Nobody erases old entries

- The notebook grows naturally

There is:

- no “first person only” rule

- no waiting

- no single boss approving entries

That notebook is like a DAG.

What “Directed” and “Acyclic” mean in daily life

- Directed means: 👉 today comes after yesterday, not before

- Acyclic means: 👉 you don’t go back and change yesterday

So life moves forward.

So do transactions.

No loops.

No rewinding.

Why this matters for machines

Machines don’t like queues.

They don’t like:

- waiting

- blocking

- approvals

They like:

- moving forward

- doing small things often

- working together

A DAG lets many machines act at the same time without tripping over each other.

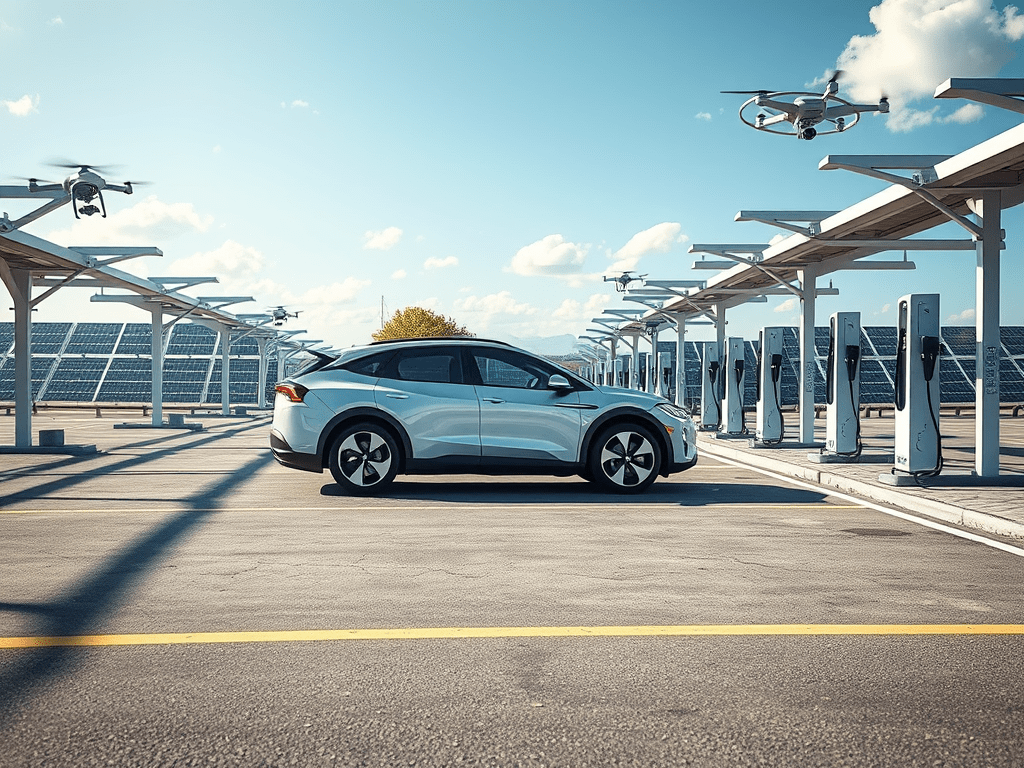

The Parking Lot That Worked by Itself

One morning, you drive an electric car into a parking lot.

The sun is bright.

The roof is covered with solar panels.

Charging points line the walls.

You park.

You walk away.

Nothing else happens for you.

But a lot happens without you.

The car checks its battery.

It senses available power.

It knows today’s charging price.

No app opens.

No card is tapped.

No approval is asked.

The car starts charging.

And here is the key question:

👉 How does the car pay?

Why old payment ideas fail here

Traditional payment systems expect humans.

They expect:

- a person

- a button

- a confirmation

But this car is a machine.

It understands only:

- energy coming in

- value going out

Charging happens every second.

Payment must happen every second.

Tiny amounts.

Many cars.

All together.

Standing in a queue won’t work.

How DAG fits naturally here

Think of each second of charging as a small note written in that family notebook.

Each note:

- adds new information

- checks a few earlier notes

- never blocks others

Cars don’t wait for each other.

They charge and pay smoothly.

This is exactly how a DAG works.

A second scene: the drone on the roof

Now imagine a delivery drone.

It lands on a building terrace with a solar panel.

It needs:

- very little power

- very little time

It takes power.

Pays a tiny amount.

Flies away.

Then another drone comes.

Then another.

No waiting.

No billing desk.

Just smooth flow.

A DAG allows this because:

- many small actions happen together

- nobody waits for a “turn”

The big idea (very simple)

Old systems say:

“Wait for your turn.”

DAG says:

“Move forward together.”

For machines, the second way is natural.

Closing Thought

Machines don’t stop to pay.

They pay while they work.

DAG makes that possible.

Not by magic.

But by removing queues.

And once queues disappear,

machines — and systems — finally breathe.

Technical Appendix: DAG vs Blockchain vs Conventional Payment Systems (UPI / Banking Rails)

— for the curious, the technical, and the restless

1. Three very different worlds (at a glance)

| Dimension | DAG-based Ledgers | Blockchain (e.g. Bitcoin) | Conventional Payment Systems (e.g. Unified Payments Interface) |

|---|---|---|---|

| Primary design goal | Machine-scale coordination | Trust without central authority | Human payments at scale |

| Core structure | Graph (many-to-many) | Linear chain (one-to-one) | Hub-and-spoke |

| Transaction ordering | Partial order | Total order | Centralized sequencing |

| Throughput model | Parallel | Serialized | Centrally throttled |

| Fees | Near-zero / optional | Mandatory | Hidden / indirect |

| Settlement | Probabilistic / local | Global consensus | Central finality |

| Ideal actors | Machines, IoT, agents | Humans, institutions | Humans, businesses |

2. DAGs: architecture-first, not finance-first

A DAG ledger is fundamentally a distributed coordination graph, not a payment queue.

Key architectural properties

- Each transaction is a node

- Each node references one or more previous nodes

- No blocks

- No global clock

- No single leader

This means:

- ordering is causal, not absolute

- progress is parallel, not sequential

- validation is participatory, not delegated

From a systems view, DAGs resemble:

- causally ordered event logs

- distributed traces

- CRDT-style convergence graphs

3. Why blockchains serialize (and DAGs don’t)

Blockchains were designed to answer one question:

“How do strangers agree on one history?”

To solve that, they enforce:

- global ordering

- block production

- leader election

- economic incentives

This creates:

- a single shared timeline

- unavoidable waiting

- artificial scarcity (block space)

For machines, this is wasteful.

DAGs take a different view:

“Agreement can emerge locally, then converge globally.”

So instead of forcing order, DAGs observe order.

4. Transaction lifecycle comparison

Blockchain transaction

- Transaction created

- Waits in mempool

- Included in block

- Block confirmed

- Block finalized

Latency and cost are unavoidable.

DAG transaction

- Transaction created

- Validates previous transactions

- Becomes part of the graph

- Confidence increases as graph grows

No block wait.

No miner dependency.

UPI / Conventional system transaction

- User initiates payment

- Central system validates

- Central system sequences

- Central system settles

- Central system records

Fast — but only because a trusted central authority exists.

5. The semantic difference that matters

UPI / Banking rails

- account-based

- identity-centric

- policy enforced centrally

- excellent for human intent

Blockchain

- asset-based

- ownership-centric

- trust enforced cryptographically

- excellent for censorship resistance

DAG

- event-based

- context-centric

- coordination enforced structurally

- excellent for machine autonomy

This is why DAGs feel “odd” if you think in banking terms —

they are not meant to replace banks.

6. Microtransactions: the breaking point

Machines transact in:

- milliseconds

- joules

- packets

- CPU cycles

UPI

- transaction cost > value exchanged ❌

- human identity required ❌

- episodic payments ❌

Blockchain

- fees often > microvalue ❌

- confirmation latency ❌

- resource-heavy validation ❌

DAG

- microvalue native ✔

- no fee pressure ✔

- continuous exchange ✔

This is not optimization.

This is fit-for-purpose design.

7. Security and trust models (hard truth)

| Model | Trust assumption |

|---|---|

| UPI | Central authority is honest and available |

| Blockchain | Majority of economic power is honest |

| DAG | Network participation is sufficiently diverse |

DAGs trade absolute guarantees for:

- scalability

- availability

- locality

For machines, this is often the correct trade-off.

8. Finality: humans vs machines

Humans want:

- absolute finality

- legal certainty

- audit closure

Machines want:

- monotonic confidence

- bounded uncertainty

- no rollback surprises

DAGs provide confidence growth, not dramatic finality events.

This mirrors:

- routing convergence

- cache coherence

- eventual consistency

Systems engineers are already comfortable with this.

9. Where each system belongs (clear boundaries)

- UPI / banking rails → Human payments, retail, compliance-heavy flows

- Blockchain (Bitcoin-class) → Sovereign value storage, censorship resistance

- DAG systems → Machine economies, IoT, autonomous coordination

Trying to force one into the other’s role leads to inefficiency.

10. Conclusion

DAGs are not “better money”.

They are better coordination substrates.

Blockchains taught us how to agree.

UPI taught us how to scale human payments.

DAGs teach machines how to cooperate economically.

Once you see DAGs as graphs of value-bearing events,

not currencies, the architecture makes sense.

And once machines can coordinate value

as easily as they coordinate data,

the rest of the system stack rearranges itself.

Leave a comment